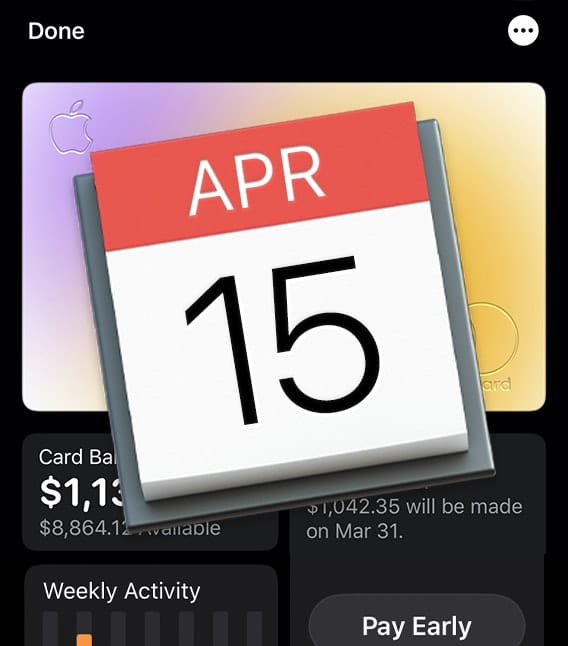

Doing Your Taxes? Here’s How to Download Apple Card Statements & Transactions

The Apple Card is amazing! Each transaction generates from 1 to 3% cashback, the card is both virtual (on your Apple devices) and real in the form of a titanium credit card with no number or magstripe, and you can...