After a short and probably very successful trial run, Apple has opened applications for the Apple Card credit card to anyone In the U.S. with an iPhone running iOS 12.4 or later. The Rocket Yard detailed the application process earlier in the month, and it is a simple process that takes only a few minutes in the Wallet app.

You’ll need a valid address, phone number and the all-important Social Security Number to apply for the Apple Card. If your credit rating is good and you don’t have a credit check lock in place, you should get immediate approval. Those who have a credit check lock set up receive a phone call from the Apple Card team asking if you are applying — once you’ve said “yes”, they’ll complete the approval. During the signup, you’ll also be asked if you wish to get a physical card. This is a thin slab of titanium with your name on it…but no credit card number.

Should you apply for the Apple Card? It does have some unique benefits. First, it’s designed to work primarily as a virtual credit card with Apple Pay, with the physical card allowing use at locations that don’t accept touchless pay. Next, Apple designed it to be one of the most secure credit cards available. It’s also set up to work hand-in-hand with the Wallet app to show you details of every transaction. The company offers Cash Back on every purchase, all of which shows up in the Apple Cash account in your Wallet. Finally, Apple wants you to pay as little interest as possible, so they provide tools to show you how to break up payments and keep

Virtual Credit Card

Apple would love to have you make all of your purchases using Apple Pay, so the Apple Card works seamlessly with Apple Pay. At any location where Apple Pay is accepted, you can choose the Apple Card as your payment method. Set the Apple Card as your primary Apple Pay credit card and you’re assured of getting Cash Back on all of your purchases.

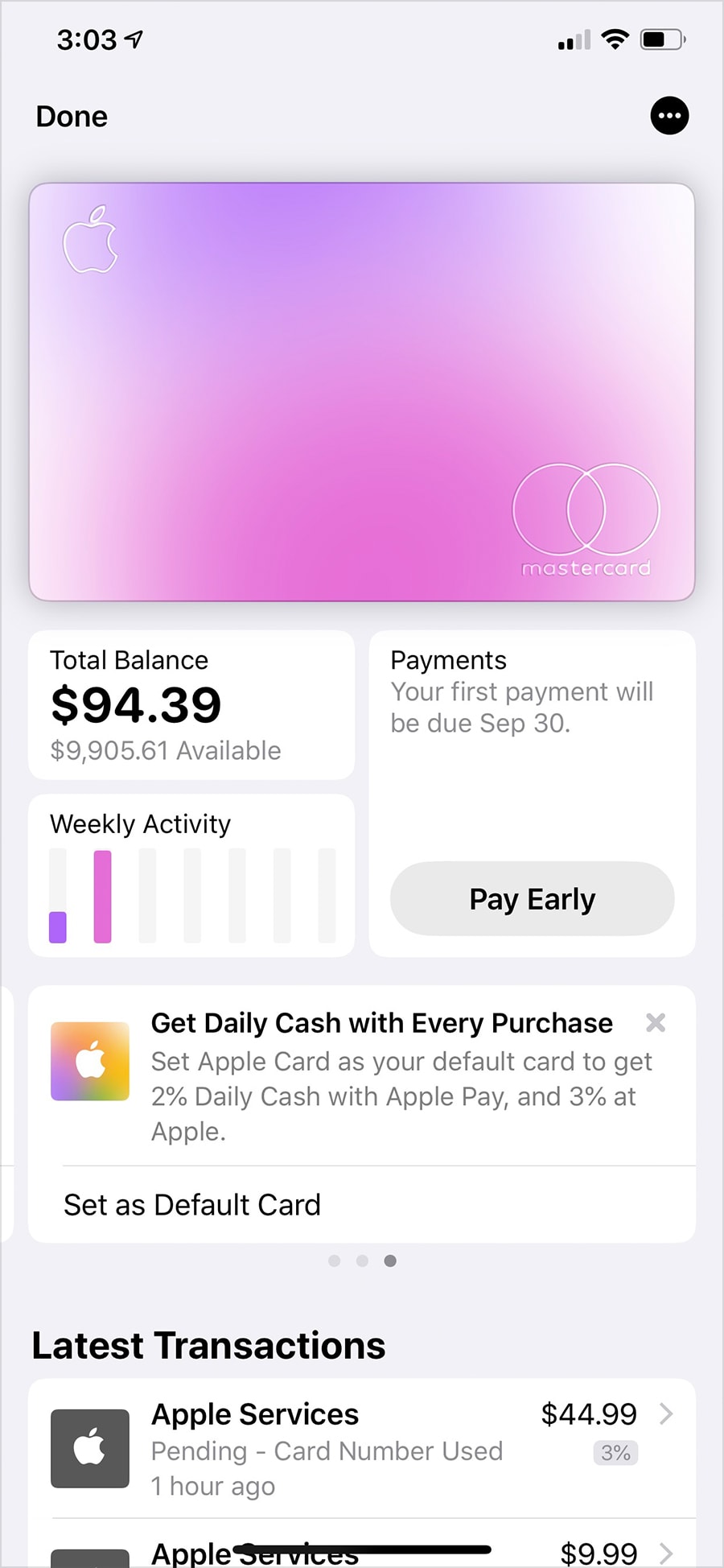

Since that virtual credit card does have a MasterCard number associated with it, you can begin to use it immediately for online purchases. To see your Apple Card number, expiration date, and security code, just tap the Apple Card at the top of your wallet, then tap the … button and select Card Information.

The screen from which you select Card Information also lets you set up scheduled automatic payments from a bank and make additional payments if you wish. You can also find your credit limit and annual percentage rate. Those with a good credit rating receive the lowest APR — 12.99%.

Better Security

The Apple Card is designed for better security. Of course, if you use Apple Pay to make your purchases, your device provides a one-time virtual card number each and every time you use it, so the card number can’t be compromised.

That security extends to the physical card, which has no number imprinted on it. Lose the card, and nobody can use it to make online purchases because they won’t know the card number, expiration date, or CVV. They can still use it to make transactions that require a physical card, but since you’ll be immediately notified of each and every purchase made with the card, you’ll know that something is amiss.

In fact, if you think that your card has been compromised, the Card Information screen allows you to replace the number on your card with a new one. There’s no need to wait for a new credit card to be sent to you unless you want a new physical card.

At any point, if you see a transaction made at a physical store that you don’t recognize, just tap on the store name to see a map with the location to jog your memory.

Have a concern about a charge that you know you didn’t make? Just tap the Message or Call buttons on the Apple Card screen in the Wallet, and you’re instantly connected to Apple Card Support. You can freeze or cancel the card immediately, although you’ll most likely just need to replace the card number.

Cash Back

The Cash Back feature of Apple Card is one of the reasons so many people are interested in getting and using the card. Each day your purchases make you money that you can spend as Apple Cash. Apple Cash can be a source of funds for Apple Pay so that cash is immediately usable on a variety of purchases.

The least a transaction earns is 1%; that’s the amount paid when a place doesn’t accept Apple Pay and you’re using the card as a regular credit card. Any purchases made through Apple Pay using the Apple Card get double the percentage — 2%. Finally, purchases of Apple products and services using the Apple Card gain 3% back. That maxed-out iMac Pro you always wanted has a price tag of $14,648, but you’ll get back $439.44…

It’s easy to make the Apple Card your preferred card for the App Store, Apple Music, and Apple services to max those Cash

The Cash Back money can also be directed right back into your Apple Card account to reduce the total amount you owe.

Monthly Statement and Paying Off Your Balance

Just about every other credit card in the world sends you a monthly statement, AKA “The Bad News”. Since you always have access to all of your Apple Card transactions and current balance through the Wallet app, Apple’s not going to send you a statement.

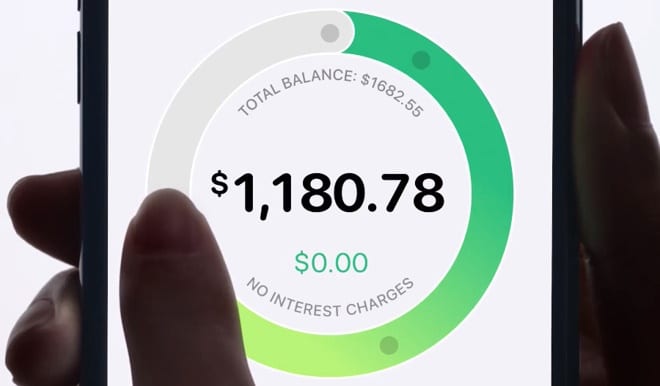

Instead, just tap on the card in your Wallet and you’ll see what your balance is, when your first payment is due, and you have the option to pay early to avoid interest charges. Since you can make a payment at any time, diligent Apple Card users can keep their balances low, paying more when they’re flush with money, paying less when things are tight.

Want to know what your estimated interest payments will be if you hold over a balance? There’s a tool for that as well. By selecting the amount you want to pay at a particular time, you can see what the interest payments will be.

The Bottom Line

Apple is trying to disrupt credit cards the way it has disrupted so many other things; by making it easier to make purchases, to track those purchases, and to pay off your debts. This doesn’t mean that you can just rack up charges, be irresponsible, and not pay off your bills. Apple is doing more than just about any other credit card provider by giving you options on how much and how often you pay, while giving users the information they need to make smart financial decisions.

Since you say there is no monthly statement, if I pay what I owe on September first will the next “due date” change to October?

Any iphone 5s running ios 12.4 is not included. Apple doesn’t offer any reconditioned iphone 6. Anyone know a reliable place to get an old iphone 6 in good condition?

Is there an interest free for new members

I’m definitely interested but when is it coming to Canada?