The last three months have been a roller coaster ride for Apple investors. Shortly after reaching an all-time high share price of $233.47 in October of 2018 and a correspondingly high market capitalization of over $1.1 trillion, various factors collided with reality to bring the price of a share of AAPL down to $142.19 just after the start of 2019. What was to blame? Wall Street analysts noted that sales of the latest models of iPhone — the iPhone XS, XS Max, and XR — weren’t as large as expected in the all-important holiday buying season, and immediately panicked. Apple didn’t help matters on January 2, 2019 when CEO Tim Cook sent a letter to investors revising the company’s guidance (estimates) on first fiscal quarter numbers, adjusting revenues downward. As of the start of trading today, shares in Apple are in the range of about $168 per share, showing a rebound from the doldrums of January. In my opinion, Tim Cook’s introduction to the Q1 2019 earnings call on Tuesday was just what the company’s finances needed to inject some reality into

The last three months have been a roller coaster ride for Apple investors. Shortly after reaching an all-time high share price of $233.47 in October of 2018 and a correspondingly high market capitalization of over $1.1 trillion, various factors collided with reality to bring the price of a share of AAPL down to $142.19 just after the start of 2019. What was to blame? Wall Street analysts noted that sales of the latest models of iPhone — the iPhone XS, XS Max, and XR — weren’t as large as expected in the all-important holiday buying season, and immediately panicked. Apple didn’t help matters on January 2, 2019 when CEO Tim Cook sent a letter to investors revising the company’s guidance (estimates) on first fiscal quarter numbers, adjusting revenues downward. As of the start of trading today, shares in Apple are in the range of about $168 per share, showing a rebound from the doldrums of January. In my opinion, Tim Cook’s introduction to the Q1 2019 earnings call on Tuesday was just what the company’s finances needed to inject some reality into

In that intro, Cook either directly addressed or implied a number of very positive points to counteract the recent negative focus on iPhone sales and revenues:

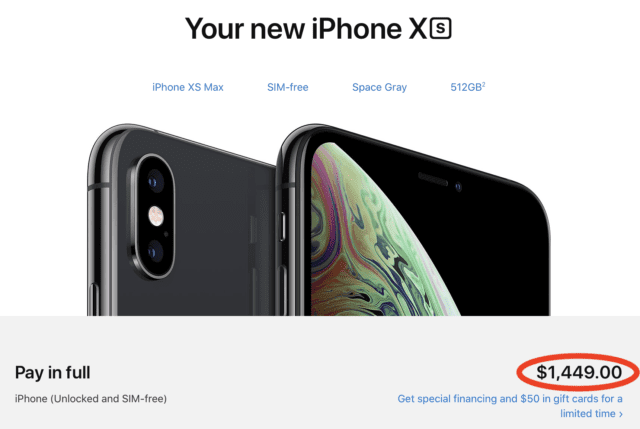

Apple is now painfully aware of price elasticity in the smartphone market

For the first quarter of 2019, iPhone revenues were down almost $10 billion. Cook noted several factors that were involved, including foreign exchange rates that made the new iPhones more expensive than ever in some countries. Part of the blame is probably due to the overall high price point for the smartphones (see screenshot below). That’s apparent not only in the fact that not as many people upgraded to the XS and XR phones, but Apple is currently pushing a “sale” in which they’re providing more for trade-ins than usual.

Sales in China were the real disaster for Apple in Q1 2019. Net sales were down almost $5 billion in China alone — that’s half of the drop in iPhone revenues. Many Chinese consumers may be looking at the high price of iPhones and choosing to stay with other domestic manufacturers like Huawei, Oppo and Xiaomi. Smartphones from these manufacturers often rival or exceed the specifications of the latest iPhones in terms of camera resolution and cellular network capabilities, although the iPhone’s in-house CPU/GPU designs mean that the Apple phones thrash the Chinese models in raw power.

Even Chinese manufacturers are having problems selling smartphones. Canalys reported a few days ago that total shipments of smartphones in China dropped to their lowest level since 2019. A weakening Chinese economy and consumers holding onto smartphones longer before replacement are said to be the cause of the drop.

The bottom line? Apple needs to find a way to make iPhones more affordable to a wider audience. In the USA, the iPhone Upgrade Plan makes getting the latest iPhone each year much less painless to consumers, so perhaps moving from selling iPhones to actually leasing them on an annual basis might attract more users.

iPad revenues bounced back on the strength of the new iPad Pro

After years of disappointing iPad sales and declining revenues, Q1 2019 brought some great news: Net sales of iPads were up over $1 billion compared to the same quarter in 2018, a jump of 16.9 percent. That shows that the release of the new iPad Pro models with Face ID, a new and more useful Apple Pencil, and the continuing adoption of iPad in enterprise may have finally turned the corner for Apple’s tablet.

Mac revenues were strong thanks to updates to the MacBook Air and Mac mini

The Mac product line had been languishing for quite a while, and revenue numbers were mixed in the past two years. Sales were up by about $600 million over the same quarter last year (about 8.7 percent), and many pundits feel that the redesigned MacBook Air with Touch ID, as well as the upgraded Mac mini were the cause. This could point to continued Mac sales growth in the upcoming quarters, as it is expected that Apple will release the new Mac Pro and a redesigned iMac during 2019.

While the Mac market is only about 14 percent of the size of the iPhone market, it still contributes a significant amount to Apple’s bottom line. Continued growth in the sales of Macs could help to cover any shortfall in iPhone revenues.

The “Wearables, Home and Accessories” line showed strong growth

Another bright spot in the Apple picture is “Wearables, Home and Accessories”, which includes Apple Watch, HomePod, and the many accessories that we all purchase to customize our Apple devices. How big is this market? Huge – at $7.3 billion for Q1, those watches, speakers and accessories almost brought in as much in terms of sales as the Mac ($7.4 billion for the same period). It’s growing quickly, too – sales rose by 33 percent in just one year, by far the most robust grown seen in any Apple market segment.

The health-oriented features of Apple Watch have become a big selling point for the line, even to the point that some health insurance companies are subsidizing the purchase of the device. The latest iteration of Apple Watch, the Series 4, has an electrocardiogram feature that can keep tabs on heart patients as well as a fall-detection capability that can automatically alert caretakers that a person has fallen and is unable to move.

AirPods are very popular, with a second-generation model of the ubiquitous earbuds rumored to arrive in 2019. On the rest of the audio front, the HomePod appears to finally be getting some traction as a smart speaker.

Apple has been rumored for the past few years to be working on augmented reality eyewear that could add informational overlays to what we see in front of us. If Apple can avoid the stigma surrounding the ill-fated Google Glasses, an AR eyewear product could boost this product segment well beyond the iPad and Mac markets.

Services and Apple’s huge installed base can keep the company afloat even while iPhone sales decline

The biggest bright spot for the Q1 2019 earnings call was Services. Tim Cook made a point of telling those listening that there is now an installed active base of 1.4 billion Apple devices on Planet Earth. Each of those devices is a potential revenue source for Apple through the sale of apps, music, movies, TV shows, and services such as iCloud.

Growth in service sales reached over 19 percent compared to the same quarter in 2018. Cook noted that Apple Music now has a subscriber base of over 50 million users, pointing to much room to grow in the future. Some persistent rumors say that Apple may be thinking about creating an “all you can play” gaming subscription plan, which could fuel incredible growth in services. As more iPhone users continue to take more and more photos, they’re all going to need more online storage space, which could bode well for iCloud sales growth.

So why are services considered such as big deal by analysts? Big margins. For the first time, Apple revealed margins for this sector and they’re huge — in the range of 63 percent. That’s almost double the margin from the hardware lines, which are usually in the 35-37 percent range.

Since the earnings call, Apple’s stock price has risen in what many are calling a “relief rally”. What they mean is that analysts are relieved that things aren’t as bad as they seemed in early January, that the company has many strong points that can help it survive weakness in the smartphone market, and that the future of the company appears to be assured based on current trends and expected future innovations. Unlike those shaky days in the late 1990s where Apple was close to collapsing under the weight of competition from cheap PCs loaded with the Windows operating system, today’s Apple has multiple product and service lines that can keep it strong despite negative trends in some areas.

iCloud services are still bug-redden, difficult to use and not at all in line with the competition. I use iCloud only for Calendar, Address Book and e-mail synchronization—oh, and now PopChar can use it so that is very helpful. I wouldn’t trust my photos to iCloud, or to the Photos app, which is losing functionality, to the annoyance of longtime iPhoto and Photos users. In Mojave you can no longer publish books and calendars directly from Photos, leaving many people floundering to find other ways to publish the products of many hours of labor in earlier versions of the macOS. If you really want to work the photos taken with your iPhone, Adobe offers great capabilities with Lightroom CC, and a discounted subscription price which includes Lightroom Classic (for desktop users like me) and Photoshop CC, with their own more competent cloud services. Just about everyone does cloud services better than Apple. Apparently, though, they haven’t noticed. The only bright spot, in my opinion, is Apple Pay, where Apple still has a big edge on the alternatives. And, of course, Apple Music, which I don’t use because I still like to own my music. Of course, I’m not the typical Apple user. I’m no longer young.

Then there is what Apple has done to OS X Server—which is to say they eviscerated it. I think Apple services are far to peripatetic to rely on long-term. I’ve been using a Mac for decades and have watched Apple quality control fall through the basement. Their thin fetish creates more problems than it solves. Which is not a good look.

I wish I could divorce myself from Apple. There products ate less and less interesting. Bring back the old paradigm where we could customize our gear. But 30 years of Apple. maybe 20 or so of them being really fun and innovative and customizable have me stuck there. The demise os Aperature and the dumbing down of Final Cut broke my heart. I’m stuck at 2011.