Like the turning of the seasons, the Wall Street reaction to Apple’s quarterly earnings calls has become a regular thing. Apple reports record earnings, and the next day the share price of AAPL drops precipitously and analysts express concern. Yesterday’s Q1 2016 earnings call was no different. The company announced record high revenues of $75.9 billion and income of $18.4 billion for the quarter ending December 26, 2016, but today AAPL stock has traded for as low as $94.04 per share after closing at $99.99 per share on Monday. So what were the key takeaways from the call that seem to have investors worried or hopeful for the future of Apple? Let’s take a look:

Foreign Exchange Rates

The big killer was how foreign exchange rates affected earnings. CEO Tim Cook and CFO Luca Maestri noted just how bad things were, with the Brazilian Real down 40% in the quarter and the Russian Ruble over 50%. This, of course, makes Apple products more expensive in these markets. Apple has had to increase prices on some of its products to keep margins high, which further reduces demand.

One big point — Apple’s revenues were about $5 billion lower than they would have been if foreign exchange rates had remained steady. Currency exchange fluctuations in the European Union were responsible for $2.3 billion of revenue loss alone.

Slower Sales Growth

Apple’s guidance to The Street for the upcoming quarter shows revenue between $50 billion and $53 billion, a wide range considering that the company usually discloses a smaller target. Maestri noted that this is due to uncertainty in the global currency markets. But the second quarter of each fiscal year (January – March for Apple) is generally less impressive than the first quarter, which encompasses the all-important holiday buying season.

Even so, the company needs to hit a home run with new product introductions over the next three quarters to keep things up. The iPhone 6s and 6s Plus, although wildly popular, are just a “speed bump” for the previous model year’s iPhone 6 and 6 Plus. The iPhone 7 needs to provide a drastically different set of specifications and features that can excite the market.

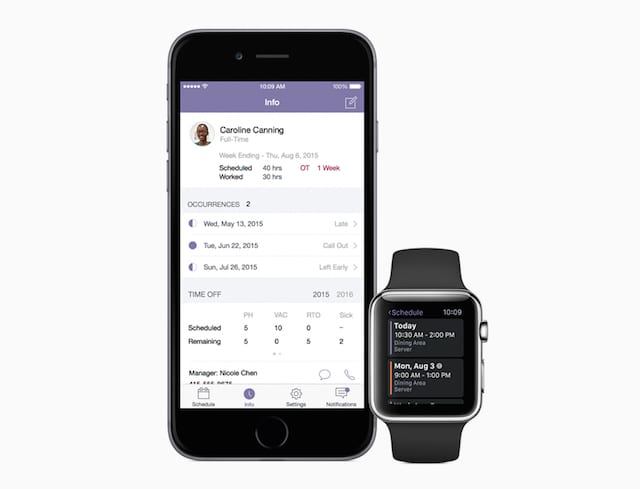

Likewise, Apple’s nondisclosure of precise sales figures for Apple TV and Apple Watch other than saying that “they were doing well” has got to be frustrating for analysts, who want to know just how much of an impact those product lines will have in the future. Apple TV is currently stymied by a lack of the promised cord-cutters bundle that would make it a competitor to cable TV packages, and the Apple Watch (though commanding the smartwatch market right now) is still suffering from the stigma of being a first-generation product with limitations in speed and battery life.

Cook and Maestri repeatedly pointed to several factors that are keeping some analysts looking on the bright side:

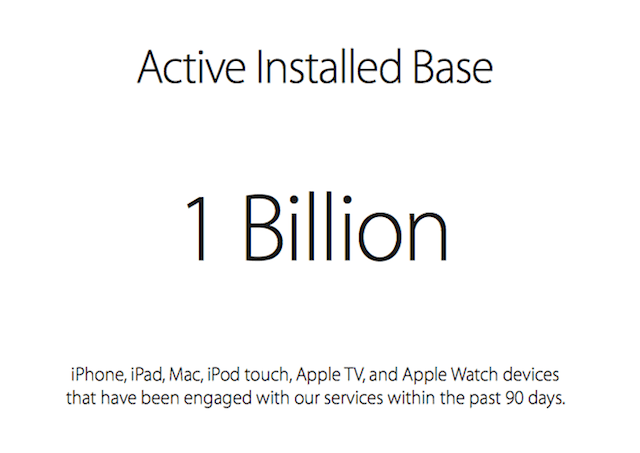

A Huge Installed Base

As noted Tuesday on The Rocket Yard, Apple has an active installed base of 1 billion devices using services that contributed to $31.2 billion dollars in revenue in fiscal year 2015. Those services include iTunes purchased content, Apple Music, App Store purchases, iCloud, Apple Pay, and more. Even if Apple were to stop producing devices today, the company would still have those 1 billion devices churning out revenue for the foreseeable future.

Improved Average Selling Price

If Apple sells fewer iPhones in the future, it can still make more money than competitors by having a higher average selling price (ASP) for each iPhone that goes out the door. Ian Fogg of IHS Technology noted that “only the strongest companies can raise ASP and shipment volumes at the same time”. ASP rose to $691, which is incredible.

Customer Loyalty

Customer Loyalty

The iPhone is Apple’s revenue engine right now, and at one point during yesterday’s call it was noted by Maestri that 79% of respondents to a survey of mobile phone buyers reported that they were planning on buying an iPhone. That number was the highest for the survey in the eight-year life of the iPhone platform and points not only to customer loyalty for existing owners, but the potential for even more Android owners to switch to the iPhone ecosystem.

Lots of Cash

The company has over $200 billion in cash held overseas at this point. That money can’t be repatriated to the U.S. without incurring huge tax liabilities, but it can be used to repurchase stock and pay dividends, both of which the company is doing. Both of those actions should have a positive effect on share price, but in reality they don’t seem to be making analysts feel warm and fuzzy about AAPL.

A Big Jump In R&D Expenditures

Whatever Apple is working on, whether it is the fabled Apple Car, virtual or augmented reality (which Cook referred to as “really cool”) or something else we haven’t even dreamed about, the company is spending a lot of money on research and development — $2.4 billion for the quarter, up almost 27% over the previous year.

However, Apple has been criticized by financial analysts for not spending enough on R&D. During the year-ago quarter, Apple’s expenditures for R&D were about $1.9 billion. Those for competitors were almost $3 billion for Microsoft, about $2.8 billion for Google, and more than $2.75 billion for Amazon.

Emerging Markets

Despite a slowing economy, China remains a bright spot on Apple’s financial picture. For example, Mac sales in China grew 27% year over year. Apple managed to also grow iPhone sales in China by 14% during the same time. If Apple can do this well during an economic downturn, things could be very cheery indeed if the Chinese economy rebounds.

India is also a huge potential market for Apple, with Maestri noting that the government is making changes that will open the market to foreign companies. There’s a huge untapped market for smartphones in India as well as a burgeoning middle class, both of which point to a potential for big growth in the country.

Whatever the future may bring, Apple is not in the weak financial position it was twenty years ago when the company nearly became a footnote to history. However, yesterday’s earning call really put the focus on how dependent Apple is on one product line — the iPhone — and why it needs to diversify its product line to maintain revenues and growth in the future.