MacSales.com is proud to ship its unmatched selection of upgrade and expansion products for Mac and iOS device users all over the world. We also strive to ensure our customers are educated about each step in the order and delivery process.

MacSales.com is proud to ship its unmatched selection of upgrade and expansion products for Mac and iOS device users all over the world. We also strive to ensure our customers are educated about each step in the order and delivery process.

In an effort to make the purchasing process as simple and affordable as possible, MacSales.com now offers a Delivery Duty Paid shipping service through UPS to a select number of European countries.

By selecting the DDP option, customers will be able to see and pay all duties, taxes, brokerage or other fees assessed on their imported order upfront along with the MacSales.com shipping fees. If the country of delivery qualifies, the DDP option will be presented during checkout.

The new DDP option brings added benefits for customers including:

- A simpler process: See your total shipping cost upfront – no unexpected duties and taxes collected upon delivery.

- More affordable shipping: COD fees are waived and disbursement fees are reduced.

- Faster delivery: Packages won’t spend time in holding while taxes and duties are settled by the local carrier.

Our quick guide below shows how to select the DDP option when placing a MacSales.com order:

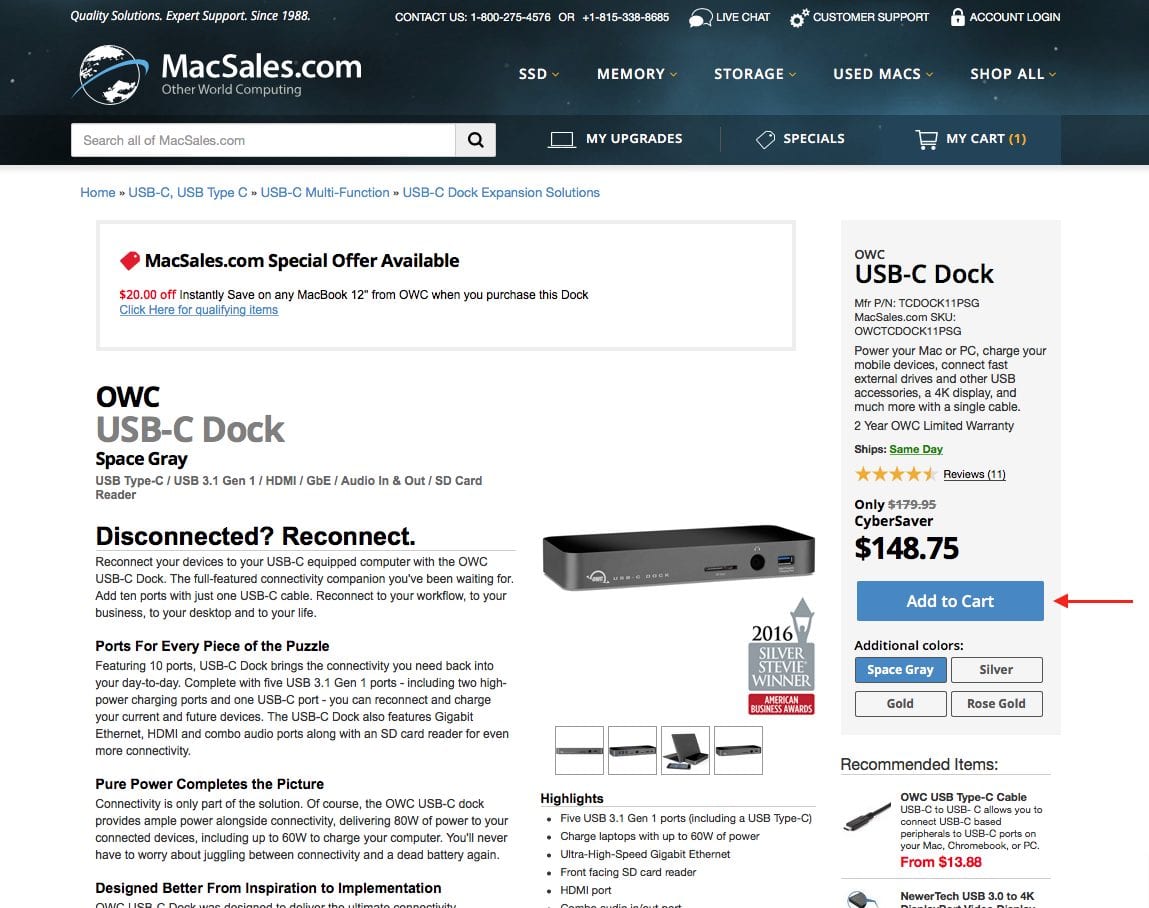

1) Choose the item that you would like to purchase from MacSales.com and click Add to Cart.

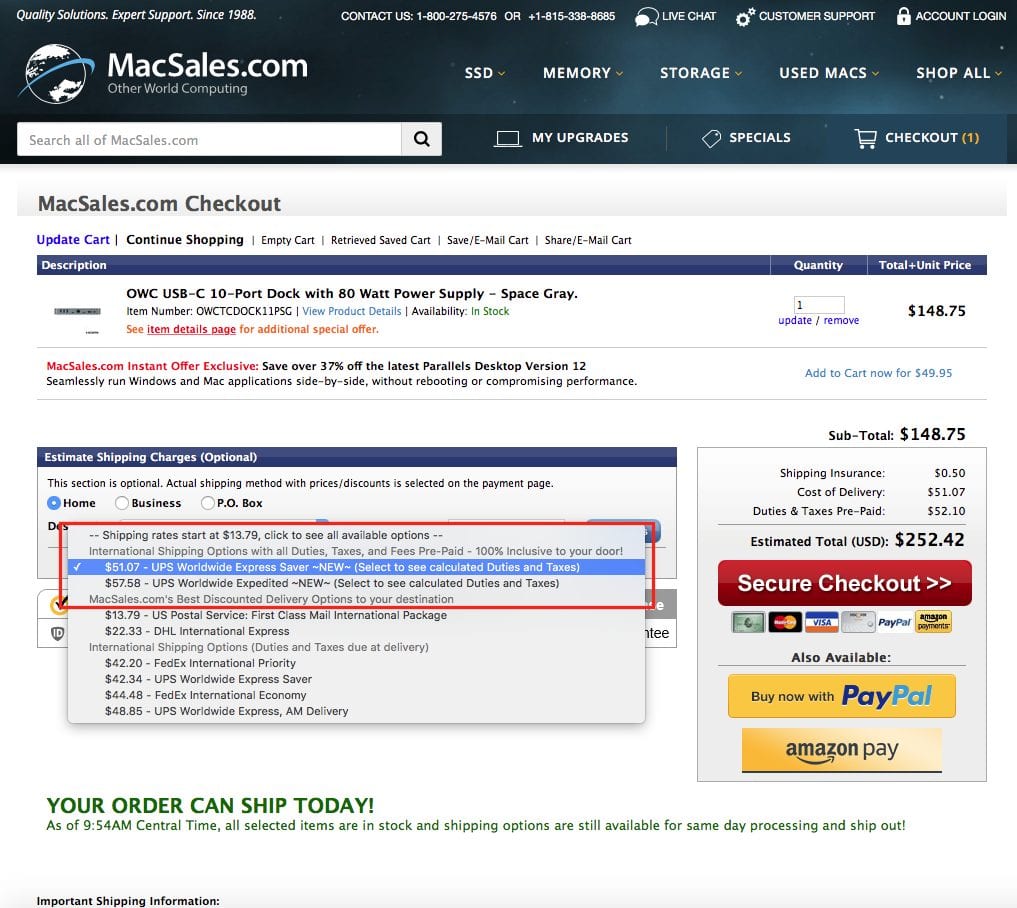

2) Once you’ve added the item to your cart and enter the Checkout process, you will need to enter your order’s destination. If your country qualifies for the DDP service, you will see options that read: “International Shipping Options with all Duties, Taxes, and Fees Pre-Paid – 100% Inclusive to your door!”

3) Once you select one of these options, on the right side of the page you will see your estimated total with delivery, duties and taxes pre-paid. You can then proceed with your checkout.

And that’s it! If you have any further questions about the Delivery Duty Paid, please contact our friendly Customer Service team!

I don’t get it… why not just pay $ 13,79 or $ 22,33 instead of $ 51,07?

I have returned my Ram becouse tax in Italy are very hard.

Hello,

great news, it will be less complex with tax, and we will know at the time of order how many it will cost at all.

Sincerely,

Gilles, France (customer for more than 15 years, Apple User Group “Les Gones du Mac”).

My experience with this is bad. The reason is in most cases, the administration in my country waves the import duties, probably because it costs more to process than its value. So please do not make that mandatory. I will opt out of this 100% of the time.

BTW, my country is sunny [today] France.

Hello,

I do find this DDP option is a very good idea : each time I ordered an item, I always was surprised the amount I had to pay when the order was delivered.

Good work guys

Greetings from Belgium

Or you could order OWC items from Belgium :-)

http://macupgrade.eu/catalog/index.php

Hi Pawel,

If you’re Polish, that is an European citizenship, you won’t be charged any VAT when purchasing / importing from the USA to Poland.

So, why would you get the VAT back when there is no VAT on your bill ?

You will simply not be paying any VAT at all.

I don’t get your question.

Can you please explain it to me ?

Thanks.

Hmmm… Great idea but probably poor execution. Assuming I am polish corporate customer with right to deduct VAT: will I get VAT amount on invoice or not? It seems it will not be separated and not invoiced with EU entity Vat id – thus not deductable). Am I right? It mah be good offer for individual importers though.

This is not about VAT. It’s about import taxes and custom charges.

Normally when I import to Sweden I pay no VAT, but later there comes an invoice from the customs with import taxes, handling fees and taxes on fess etc.

Those taxes and fees can be quite high and easy to forget when ordering.

With DDP you get a much more clear picture of the total cost.

Great offer! Now it’s easier to get nice Items from mcsales